What We Said!

This week, we witnessed the largest interest rate decrease since March 2020, with a 50-basis point drop in the U.S. I hope you remember the beginning of the pandemic—or maybe you'd prefer to forget it altogether. But I want to bring your attention to what we wrote at the beginning of this year: “If all the above holds true, then we are about to fall off an economic cliff in Canada. Until recently, the U.S. has been the only country experiencing growth over the past two years globally. I am skeptical of the government data because when countries like China and most of Europe are slowing, it seems illogical that the U.S. continues to grow. But who knows, maybe the politicians are actually truthful – I don’t think so! Rates are coming down regardless of what Tiff Macklem says publicly. Expect the bank rate to be at least 200 basis points lower by the end of the year.”

In Canada, we have started to see the drop in rates, with 75 basis points being wiped out over the summer. Expect that trend to continue and most likely accelerate through the balance of 2024 in both Canada and the U.S., and into mid-2025. Think about the fact that unemployment among 18- to 25-year-olds in the U.S. now sits at 18.8%. The outlook in Canada is not much better for our youth.

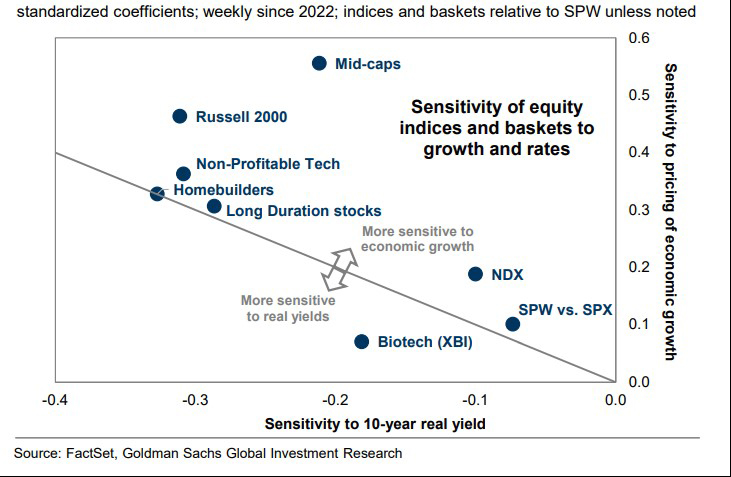

From an investment standpoint, value investing has taken off, with banks, insurance companies, utilities, and REITs having their best performance in years. Gold and other precious metals prices are taking off, but there is one sector that has not yet experienced growth but soon will: biotechnology. Attached are charts from Goldman Sachs that point to the huge potential in this sector as real interest rates fall precipitously in the coming months.

On Tuesday, the following was written: Regardless of whether it is 25 or 50 on Wednesday, we are entering a cutting cycle, and this should be well received by biotech. Rates play a larger role than growth in driving share prices in biotechnology (the only sector where this is the case). The option-like structure of many smaller-cap biotechnology companies inherently creates interest rate risk. With little to no profitability today, but expected profitability if trials are successful, biotechnology cash flows are generally long-duration. For investors who believe that bond yields will decline from here, biotechnology stocks could offer better exposure than other rate-sensitive parts of the equity market, which will be more dependent on the trajectory of economic growth.

January 12, 2024 Newsletter

Rates are dropping like the Temperature

This morning, U.S. PPI numbers were reported, revealing deflation in some input prices – I guess this was a surprise! The actual headline for December PPI declined by 0.1%, with energy being the largest drag down (negative 1.2%). Core PPI (excluding food and energy) remained flat from the previous month (November), and November itself showed no change. Areas experiencing increases included airline passenger services, software publishing, and security services. However, these were more than offset by a significant drop in machinery/vehicle wholesaling (negative 5.5%).

In Canada, a staggering 88% of all Canadians believe that the country is already in a recession, and 20% of restaurant owners have stated that they may need to close their operations if required to repay their CERB loans now. Remember that the deadline to repay these loans has already been extended twice. Given the food inflation observed over the past two years, it makes sense that these small businesses would face challenges with their cash flow.

What does all this mean? It appears that the supply/demand issues created during Covid have mostly resolved themselves, consumers have finished spending their extra savings on basement renovations and backyard upgrades, revenge travel has subsided, and the U.S. Fed is nearing an interest rate cut. However, inflation has taken a toll on many small businesses, as their margins have been squeezed due to the lack in pricing power enjoyed by larger companies.

If all the above holds true, then we are about to fall off an economic cliff in Canada. Until recently, the U.S. has been the only country experiencing positive growth over the past two years globally. I am skeptical of the government data because when countries like China and most of Europe are slowing, it seems illogical that the U.S. continues to grow. But who knows, maybe the politicians are actually truthful – I don’t think so! Rates are coming down regardless of what Tiff Macklem says publicly. Expect the bank rate to be at least 200 basis points lower by the end of the year.

Other points to consider:

- Olivia Chow, Mayor of Toronto, is proposing to raise property taxes by 10.5% or 16.5% this year. The 10.5% is deemed doable if the Feds pony up $250 million to help the city. Such a percentage increase is substantial, emphasizing the limits to spending other people's money.

- The global share of the economy is undergoing seismic shifts. Over the past 30 years, the U.S. and its allies have seen their share drop from 90% of the global economy to only 67%. China and its allies now make up 27%.

- What would we do without oil and gas? Minus 46 in Calgary today and getting colder. Much of Canada and the US are under extreme cold warnings. I was thinking of turning my thermostat down to reduce my carbon footprint but I thought staying alive was the better option! Or maybe I could climb on my roof and clear the snow off of the solar panels!