Too High for Too Long

Economic data continues to indicate slowing economic activity globally, with the latest employment numbers in Canada and the U.S. falling below expectations. Furthermore, the previous months' numbers are now being revised downward to reflect slowing job growth. Remember that employment, or the lack thereof, is a lagging economic indicator. The reason for this is that companies tend to retain employees longer during a downturn and hire after an upturn in the business cycle—employment is reactive rather than proactive at most companies.

With the drop in employment numbers, the potential for interest rate decreases has increased dramatically. In fact, Fed Funds futures for one year out are now showing that interest rates will be 240 basis points lower. The current Fed Funds rate is 5.25-5.50%, meaning that rates in the U.S. will be close to 2.85% to 3.1% by September 2025. In Canada, we have already seen a 75-basis point cut in our bank rate, and with our economic backdrop, I would expect another 1.5% to 2% drop over the coming year, bringing the rate to approximately 2.5%. Obviously, these interest rate cuts are good news for variable-rate mortgage holders and companies with floating-rate debt, but not such good news for investors who rely on their assets for income. The 5% GIC is now a thing of the past, and with the continued decline in rates, look to high-dividend blue-chip companies to benefit from lower rates.

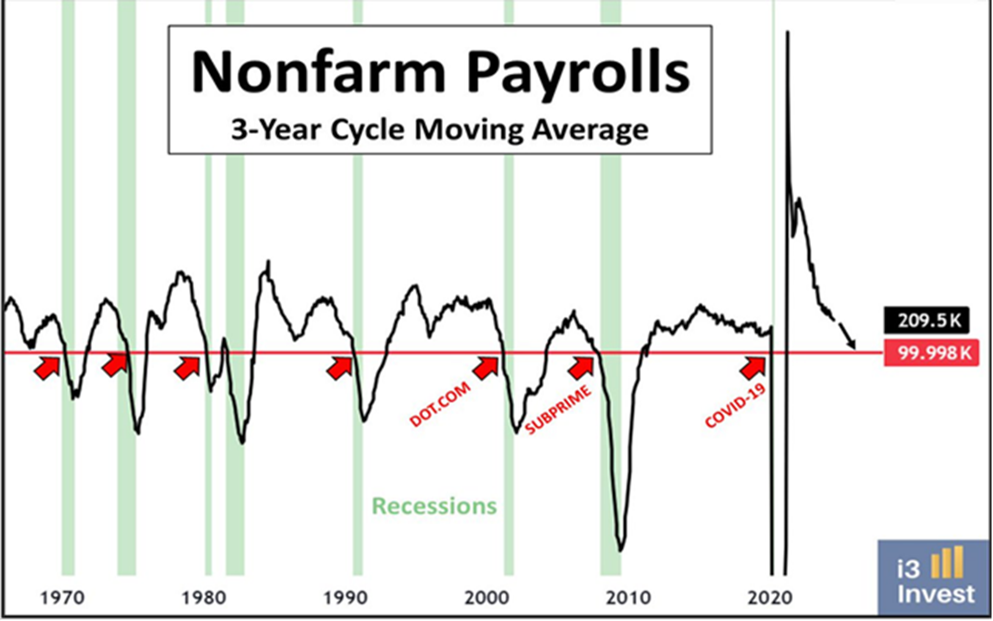

With the weak economic news, comes the fear of a recession. Below is a chart of the three-year Nonfarm Payrolls (U.S.) going back to the 1960s. This is a moving average to remove seasonality. The graph clearly shows that we are entering a recessionary period, which most likely would have occurred sooner if COVID-19 and the subsequent massive government spending had not intervened.

As an investor, do not fret! In fact, you can still make significant returns if invested correctly. To reiterate, dividends from companies focused on consumer staples, financial services, insurance, telecom, pipelines, and utilities will continue to be safe havens and should become outperformers.

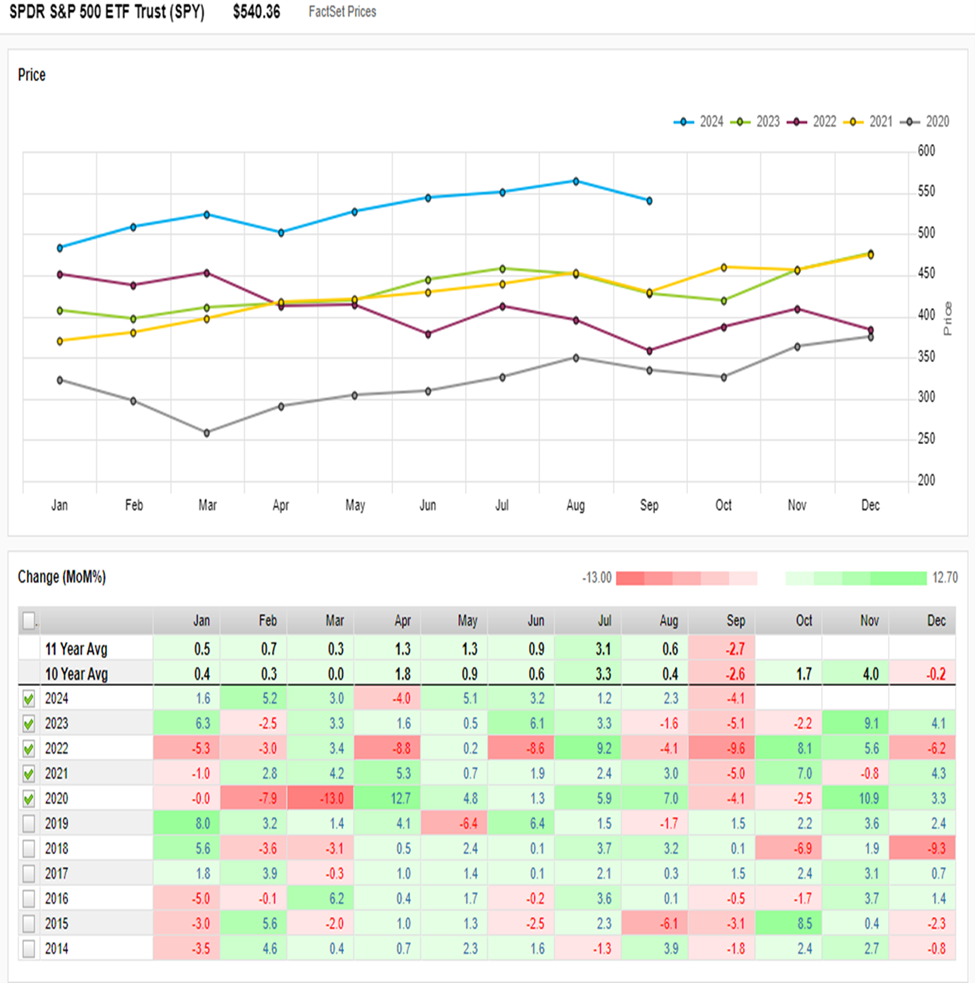

Finally, August was a stellar month overall for performance, but September is looking grim. A second chart below illustrates market seasonality—be patient, as September is historically the worst month for performance. Once we move into late October, equity markets tend to gain positive momentum.