AI, AI, AI, Tariff, Tariff, Tariff, Trump, Trump, Trump, Beetlejuice, Beetlejuice, Beetlejuice!

AI, AI, AI! Oh, my goodness, what a week. By now we all know that artificial intelligence is taking hold, with trillions of new investment dollars flowing into the industry. Computing power is becoming more powerful by the day. Competition to dominate the large language space is fierce – Anthropic, ChatGPT, and Orca, to name a few, are competing to become the globally preferred language model. However, energy consumption for these massive facilities is also fierce. Combined, the AI, crypto and associated server farms consume almost 2% of the world’s electrical energy. As demand grows, where does this energy come from? Options include nuclear, hydro-electric, coal, and natural gas. Of all these energy supplies, natural gas is currently the easiest and cleanest to expand. Both the U.S. and Canada are abundant in natural gas resources. The question for Canada, will our politicians get out of the way of progress and allow us to make money from the vast resource?

The mania around AI reminds me of the early 2000s, when the internet began to boom. Although a few companies flourished (Google), most blew up. Today, there are a vast number of companies attaching the AI moniker to their name to attract your attention and dollars. Be careful! Just because these companies claim to have AI capabilities does not mean they do. Unfortunately, companies will create new ways to value their businesses (e.g., number of leads) to making claims that they have partnerships with large multinational companies to help those companies discover new drugs, to the detriment of the uniformed investor.

Tariff, Tariff, Tariff(s) are a problem for Canada, the US, and the global economy. Tariffs, when used to alleviate unfair trade practices, are a useful tool. For instance, when a country artificially sells a commodity, like steel, at below market rates because the government, where it is manufactured, is subsidizing the domestic industry to steal market share from other companies operating in other countries (China has been known to do this historically).

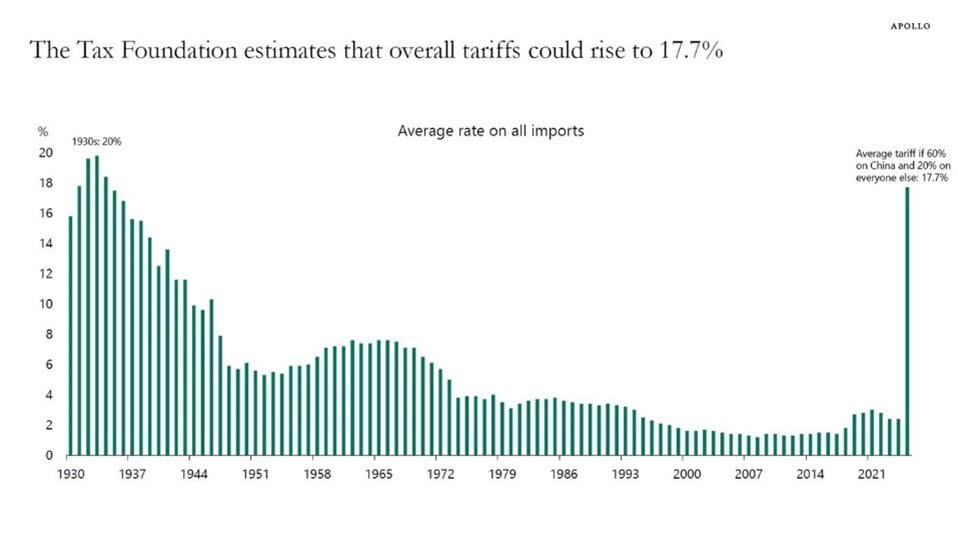

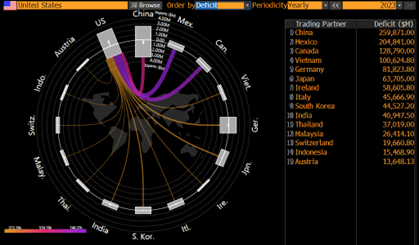

But when tariffs are used as a political weapon, the consequences can be extremely damaging to all the trading partners. Specifically, if the 25% tariff is imposed on Canada, we could see our GDP shrink by almost 2.5% within the year, likely pushing us into recession. If all the proposed tariffs are applied, then money flow will start to slow exponentially. At the same time, inflation in the U.S. would increase by 0.4%, forcing interest rates higher in the U.S., which would slow their economy – and then that spills over to other countries and slows their economies even more – it could get ugly. For reference, if the U.S. imposes all the proposed tariffs, it will bring the percentage to 17.7% of all goods imported into the country. The last time this happened was 1930. Most of us have grandparents and parents who survived these times – I would guess that they are universally frugal because it was not a fun time. Please read the two charts that are attached that provide a visual of the impact of tariffs.

Trump, Trump, Trump! As to the claims that the U.S. funds Canada each year by $100 billion, well, that is simply not true. The facts are that we have a trade surplus with the U.S.; they buy more stuff from us than we buy from them. And they should, because they are 10 times larger than we are in population. What seems to be forgotten is direct foreign investment. This is when a foreign-owned company invests into a company in another country. In 2022, Canadian direct foreign investment into the U.S. was over $150 billion USD more than the U.S. had in Canada, and with only 10% of the population of the U.S. Unfortunately, Canada has not invested as much into itself. Current investment per worker in Canada is 50% less than it is in the U.S. Currently, U.S. companies invest $28,000 USD per worker annually, while Canadian companies invest just $15,000 CDN. This lack of investment leaves us vulnerable to unfair trade practices.

Whether you agree with Trump’s delivery or not, it is time to return to common sense and business. Let’s start building pipelines, LNG facilities, reduce red tape, stop drug dealers, and protect our borders. Canada, Europe, and many other developed countries cannot afford to neglect investment in themselves any longer. I have mentioned before that the U.S. economy now accounts for 50% of the G7’s total GDP, up from 33% just over 30 years ago. Why? Simple: they invest into their own companies domiciled in the U.S. Trump will be even more forceful. To be competitive, other countries, including Canada, need to foster investment through reduced regulation, lower corporate taxes (actually eliminate capital gains tax for investments into Canadian companies), and expand trading partners for our resources rather than relying upon a single trading partner, which has made us weak. Think about it, we have a handful of banks, three large telecom players, less than 10 insurance companies, and three large airlines. For decades, we have been complacent. This is a wake-up call.

Beetlejuice, Beetlejuice, Beetlejuice – Say his name three times and he appears. Trump loves to repeat himself. Maybe if he says something enough, it will just happen (like interest rates will go down or OPEC will lower oil prices or Canada will become the 51st state) or something unforeseen could also take hold. Canada, Mexico, and the rest of the G20 countries could start to reinvest in themselves, cutting the U.S. out of trade. Tariffs could cause an economic catastrophe, if used incorrectly. Maybe Elon Musk decides to use his vast satellite network for something untoward while manipulating the X algorithm to make people believe that he is now in charge of the U.S.! Maybe he already is.